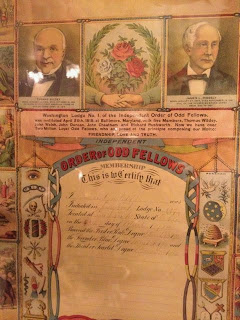

I recently got back from Texas where I visited an antique shop in which I found these interesting banners belonging to the International Order of Odd Fellows. The IOOF are a "friendly society" which originated in Britain in the 17th C and was later brought to the US and then to many countries in the world. The three pillars that they follow are love, truth and friendship. I think I'd like to make some similar banners, but am still anticipating connexions B and C. I suspect it would be in the form of investigating the visual culture of the rural friendly societies in the developing world, and tracing connections to those in the West.

The French Revolution caused "the establishment" to view organisations such as the Oddfellows and Freemasons with fear. Membership became a criminal offence in France, and such organisations were driven underground and forced to use codes, passwords, special handshakes and similar mechanisms. Fear of revolution was not the sole reason for persecution; Friendly Societies like the Oddfellows were the predecessors of modern-day trade unions and could facilitate effective local strike action by levying all of their members for additional contributions for their benevolent funds, out of which payments could be made to the families of members who were on strike.

In 1911, when Asquith's Liberal government was setting up the National Insurance Act in Britain, the Oddfellows protected so many people that the government used the Oddfellows' actuarial tables to work out the level of contribution and payment required. At that time the Oddfellows was the largest friendly society in the world. Since the welfare state of 1948, the role of the Oddfellows has been to move into financial products.

The IOOF was brought to the US by ex-pat Thomas Wildey in 1819, and they later separated from the English branch. After the Civil War, with the beginning of industrialisation, the deteriorating social circumstances brought large numbers of people to the IOOF and by 1889, the IOOF had lodges in every American state. From 1860 to 1910/1920, also known as the "Golden Age of Fraternalism" in America, the Odd Fellows became the largest among all fraternal organisations, (at the time, even larger than Freemasonry). By 1915 the IOOF had 3.4 million active members worldwide. The IOOF declined in membership in the US with the New Deal, and generally everywhere with the welfare state.

Interestingly, some new chapters have sprung up in even the last 20 years such as in Estonia and Dominican Republic, and Italy in 2010. On the other hand orders have existed in Nigeria since the 1800s which were re-established in the country in 2008.

Many of these societies still exist in the developing world often as rural banks or ROSCAS (Rotating Savings and Credit Association). These tie payments to seasonal cash flow cycles in rural communities and are said to aid savings where family and relatives may demand access to savings, where there are low levels of literacy and where there are weak systems for protecting collective property rights.

Interestingly, some new chapters have sprung up in even the last 20 years such as in Estonia and Dominican Republic, and Italy in 2010. On the other hand orders have existed in Nigeria since the 1800s which were re-established in the country in 2008.

Many of these societies still exist in the developing world often as rural banks or ROSCAS (Rotating Savings and Credit Association). These tie payments to seasonal cash flow cycles in rural communities and are said to aid savings where family and relatives may demand access to savings, where there are low levels of literacy and where there are weak systems for protecting collective property rights.

They take various cultural forms, according to wiki:

Variously called "committee" in India and Pakistan, Ekub in Ethiopia, Susus in Southern Africa and the Caribbean, "Seettuva" in Sri Lanka, tontines in West Africa, wichin gye in Korea, arisan in Indonesia, likelembas in the Democratic Republic of the Congo, xitique in Mozambique and djanggis in Cameroon, ROSCAs are informal or 'pre-co-operative' microfinance groups that have been documented around the developing world. A famous early study by anthropologist Clifford Geertz documented the arisans of Modjokuto in Eastern Java. He described them as "an "intermediate" institution growing up within peasant social structure, to harmonize agrarian economic patterns with commercial ones, to act as a bridge between peasant and trader attitudes toward money and its uses."The individuals in the ROSCA select each other, which ensures that participation is based on trust and social forces (see Social capital), and a genuine commitment to participate.

No comments:

Post a Comment